Key Challenges :

- The behavioural AI model found anomalies with the “Insurance Settlement Administration” page, where a hacker was persistently

submitting bot-driven insurance claims - This was relayed out to the customer in real-time to check the veracity of the findings. The customer confirmed and noted that this could have resulted in hundreds of thousands of claim submission requests flooding the system in a short time, making it difficult for employees to process claims and identify legitimate requests

- The hacker had carefully designed the bots to mimic human behavior, filling out all required details on the claim page accurately

- Additionally, identifying the bots was challenging because they were deployed through browser-based automated tools rather than

command-line interface (CLI) tools - The hacker utilized over 100,000 IP addresses, submitting more than 200,000 claims

- The attack evolved every day and the rules had to be tuned regularly while eliminating false positives

Solution :

The customer already used the behavioural bot module on AppTrana WAAP.

Once the anomaly alert triggered, the 24/7 SOC team took a quick confirmation from the customer and deployed the mitigation

mechanisms.

The summary of the mitigation approach includes :

- Deploy a very low tolerance for requests per URI. Any URI exceeding this threshold was blocked

- Any signs of malicious bot activity-regardless of tools, geography, or device-were met with CAPTCHA or tarpit challenges first, and if suspicious behaviour persisted, users were blocked for extended periods

- Accept traffic solely from the geographical locations where insurance claims were permitted, blocking requests from all other locations

- Deploy time-based rate-limiting rules to block any user who filled out the form at a significantly faster rate, calculated by the behavioural AI model, than normal or submitted multiple forms within a specified time-frame

- Prevent the exploitation of any business logic vulnerabilities in the claim process, ensuring that user input-from insurance numbers to

other details-was more specific and unique

The AI model on AppTrana WAAP continuously evolved with the hackers’ methods and the attacks stopped within a couple of days.

This is a classic case of human (Indusface 24/7 SOC and customer’s DevOps team) and AI (behavioural bot module) working together to

ensure that attacks are thwarted with minimal false positives.

AppTrana successfully blocked over 2 million targeted attacks, leading zero cases of false claims registered on the customer’s site

Results :

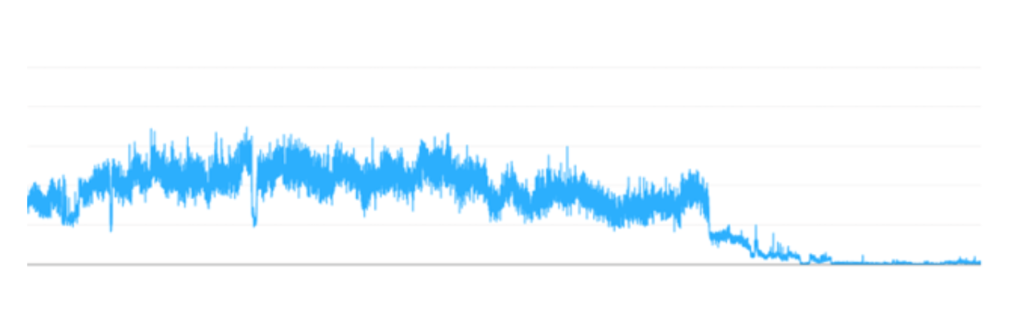

- Over 2 million attacks blocked in a couple of days

- Prevented potential losses of hundreds of hours and thousands of dollars lost in processing fraudulent claims

- Achieved zero false claim submissions with AppTrana WAAP

- Strengthened security measures, reducing vulnerability to future attacks

AppTrana WAAP Platform

AppTrana WAAP Platform